While the most difficult parts of app development are definitely coming up with the idea itself and then executing it, it’s still far from over once you actually make […]

What has changed in the banking sector is the increase in customers using online platforms and apps to monitor their accounts. Since more people became familiar with mobile banking the traditional way of securing their data has become uncertain. What’s more, there are enough people for whom the traditional way of using banking service is just inconvenient. As we know, the need is the mother of inventions so in 2020 the financial sector came up with many interesting ideas on how to modify and improve mobile banking apps.

Even though passwords seem to provide full security, the reality shows they can be easily broken. With the increase in daily breaches, the company Veridium suggested a solution that replaces a traditional password-based login with biometrics. Biometric recognition is a system that provides access to an individual based on their physiological or psychological characteristics. Such a trait can be someone’s voice, face, fingerprint but also behavior. Basically, it’s a password that cannot be forgotten as it belongs to someone’s personality. Apart from being more secure, biometric authentication works faster and is more convenient to use. As was shown in the MasterCard study, the vast majority of users are willing to adopt the new method as a replacement for passwords. Financial institutions all over the world have already started to invest in biometrics. KB Kookmin Bank has already delivered its app with an iris-scanning system.

The public transaction ledger for cryptocurrencies has been recently explored by the banking sector. When looking at statistics, finance was the biggest blockchain value sector in 2018, having 60,5% of a market share. The technology enables the recording of transactions and provides a clear picture of one’s account status in real-time. It means the data are constantly updated providing transparency between trade partners and preventing fraud. The use of blockchain in the banking sector improves efficiency and shortens the transaction time not to mention the cost savings on both sides. The advantages of working with technology can be seen by the number of banks implementing blockchain to their structure.

With the success of Siri and Alexa, voice assistants are also on the banks’ wishlist. The easiness of asking questions and immediate redirect to the right section is something that many of us desire in an app. The prediction is that by the end of 2020 most of the internet browsers will be screenless and operated by voice. Santander has already launched a new voice banking app that allows users to conduct payments, inquire about transaction status or report a stolen card using voice only. Apart from that, there is Erica, which as a voice assistant enabling users to make money transfers available 24/7. According to Aiqudo, in one year the number of Erica’s users reached 7 million. In parallel, there is a project called Venmo, in which with the help of Siri you can also make payments using voice. The last example is Eno, introduced by Capital One.

The trend for cardless cash withdrawals will be definitely growing. The idea is to withdraw cash using only an app to make it more convenient for people who at the moment don’t have a card or they somehow lost it. The new feature would also reduce queuing time. Cardless ATM may be a successor for digital wallets that nowadays are very popular. The invention was already introduced by Chase Bank. ATM may scan QR code from the app or as Chase Bank did collaborate with Google Pay, Samsung Pay, and Apple Pay. KB Kookmin Bank also suggested something similar providing easy palm vein recognition services for cash withdrawal.

The general idea is to create one platform from which a client can manage all of their bank accounts. It aims to provide personalized user experience by offering a network of financial services. With no doubt, such an app would be more convenient for clients as they no longer have to log in to each bank separately. Money operation takes less time and each client has a clear view of one’s expenses. MoneyStrands is an app where you can do all of that and even more. Apart from adding different bank accounts, you can also analyze your daily cash flow and savings. Open banking definitely needs a few years to be better adapted but it’s a trend that has already started in the UK, Sweden or Hong Kong.

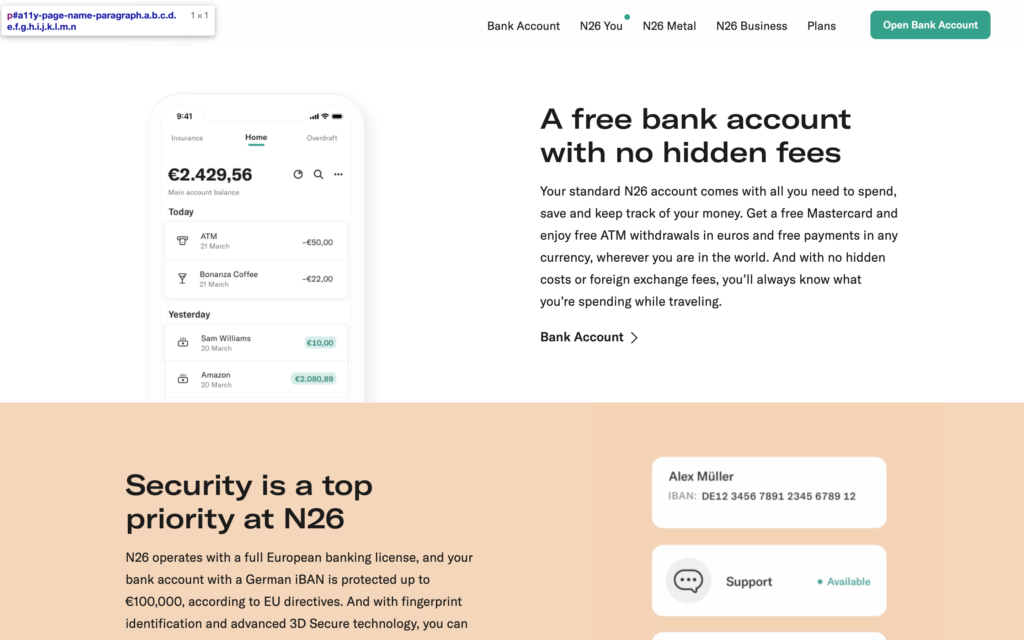

Digital-only banks gain popularity because of the growing number of people preferring to download an app than going to the finance branch. At the end of last year, the global investment in payment services and Neobanks increased by more than 40%. Revolut is one of the most successful online banks having an impressive range of services and 4.5 million customers. It offers 29 currencies in which one can make a money transfer (cryptocurrencies as well). The clients receive also a card that enables cash withdrawal in 120 countries. Next to Revolut, there are also Monzo, Simple and N26. Currently, Australia, the US, and Europe are the leading ones when it comes to Neobanks.

The banking experience as we know may change in a period of 2 to 5 years. The traditional manual-based system will surely be replaced by mobile apps and new technologies that are yet to come. For companies, the most important will be to keep the balance between introducing online mechanisms and reducing the number of physical branches. Also, they need to remember that today’s customers are more demanding and personalized banking experience is the key to success.